Insurance companies now face annual losses of over $100 billion from natural disasters. Social inflation has driven liability claims up by 57% since 2013. These numbers tell a clear story – the insurance industry’s future looks radically different from its past.

Insurance professionals recognize this reality. Their response shows in the numbers – 78% plan to increase their technology budgets in 2025. The industry is experiencing a major change in technology and trends, ranging from AI-powered solutions to eco-friendly insurance models. Our research reveals an exciting possibility – cross-industry alliances could create revenue potential worth $100 trillion by 2030.

Seven critical trends will transform insurance operations, competition, and customer value delivery by 2025. These developments will affect your business strategy significantly, regardless of whether you run a 50-year-old insurance company or lead a growing insurtech startup.

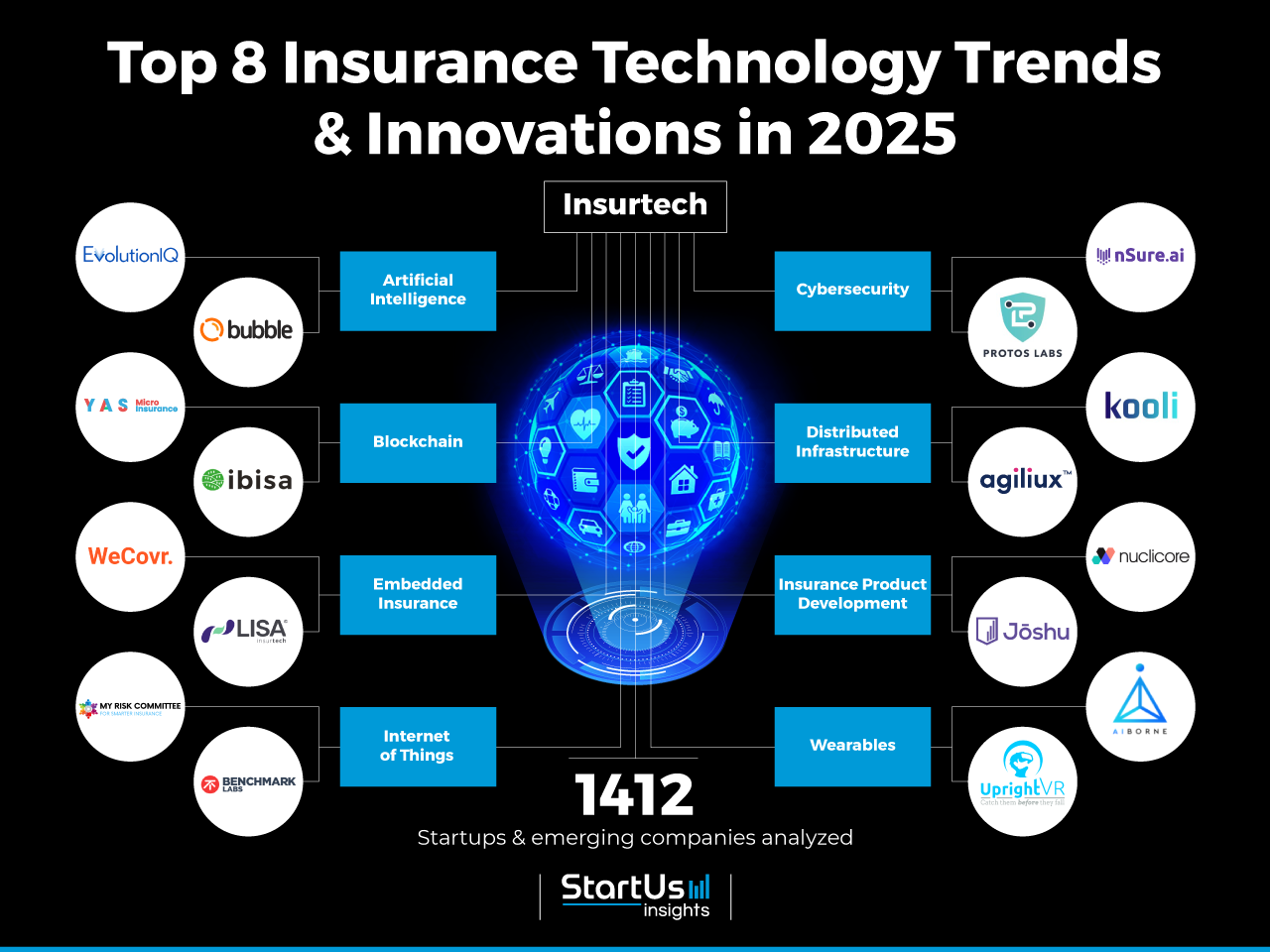

AI-Powered Insurance Technology Revolution

Image Source: StartUs Insights

U.S. insurance firms are moving faster toward artificial intelligence adoption. Research shows that 76% of these companies now use AI capabilities in at least one business function. These companies focus their technological changes on claims processing, customer service, and distribution channels.

AI Applications in Insurance Claims Processing

Computer vision and automation technologies have transformed the claims processing landscape. Modern AI systems analyze images and videos to review vehicle and property damage. These systems determine repair costs and reimbursement amounts. Claims that once took weeks now take just hours to process. Fukoku Mutual Life boosted its productivity by 30% and saved $1 million each year by using AI-powered claims management.

Machine Learning for Risk Assessment

Risk assessment has seen a radical alteration through machine learning algorithms. These systems process big data sets 100 times faster than traditional methods. The algorithms find patterns and relationships in complex datasets that human analysts might miss. This leads to:

- Up-to-the-minute risk monitoring and compliance alerts

- Better data segmentation for detailed risk analysis

- More accurate forecasts in complex scenarios

- Better threat detection with fewer false positives

AXA cut its risk engineering survey processing time by half using natural language processing models.

AI-Driven Customer Service Innovations

Virtual agents powered by AI now offer round-the-clock customer support with tailored responses. Natural language processing helps these systems understand customer needs and provide quick service. Chatbots handle multiple customer conversations at once, which reduces the workload for human representatives.

Implementation Costs and ROI

Custom AI solutions cost between €6,000 and €300,000. The investment pays off well – companies that adopted early saw 14% better customer retention. AI-powered fraud detection shows impressive results too. One insurance provider achieved an 87% success rate in fraud alerts, recovering £44.5 million and preventing £54 million in fraudulent payments.

Data infrastructure and availability present the biggest implementation hurdles. Insurance companies struggle with isolated data and old systems that make AI integration difficult. Success requires companies to change their culture and work across departments. They should focus on platforms with deep insurance expertise instead of generic solutions.

Climate Risk and Sustainable Insurance Solutions

Image Source: Deloitte

Environmental insurance capacity will stay strong in 2025. Median pricing showed a small 1.4% uptick in early 2024. The market remains stable despite growing challenges from climate-related risks and bigger claims.

Environmental Insurance Products

Two core products dominate the market: Pollution Legal Liability (PLL) for fixed facilities and Contractor’s Pollution Liability (CPL) for job site coverage. Carriers have expanded their product line to include:

- Carbon capture and storage coverage

- PFAS exposure protection

- Indoor air quality protection

- Natural resource damage coverage

Parametric insurance has emerged as a trailblazing solution that offers pre-defined payouts based on specific climate-related triggers. These policies have become popular by offering efficient climate risk coverage.

Climate Risk Modeling Advances

Modern climate risk modeling has revolutionized how insurers assess and price environmental risks. Insurance carriers now use sophisticated catastrophe models to capture both near-term and long-term climate change risk outlooks. These models help insurers optimize their portfolios and include climate change factors in their catastrophe risk assessment.

Higher remediation costs have pushed carriers to take a more active role in claims processing. Better modeling capabilities now let insurers assess complex scenarios including mortality rates, longevity effects, and financial variables across different time periods.

Green Insurance Initiatives

Insurance companies have adopted green practices through the UNEP FI Principles for Sustainable Insurance (PSI). This global framework helps address environmental risks and opportunities. We focused on developing innovative solutions that support the shift to a more sustainable economy.

Natural disasters caused total losses of USD 380 billion globally in 2023. Only USD 118 billion was covered by insurance. Insurance companies are creating new products to close this protection gap by rewarding sustainable practices. Some carriers offer premium discounts when properties meet specific construction standards or add severe weather protection.

Digital-First Insurance Distribution

Image Source: Feathery

The insurance distribution technology market will expand remarkably. Projections show it reaching USD 50.70 billion by 2029 with a 16.4% CAGR. This growth shows how insurance products now reach consumers in completely new ways.

Mobile-First Insurance Platforms

Mobile technology is the lifeblood of modern insurance distribution. Insurers now develop intuitive apps that let customers insure items just by taking pictures. These platforms help users manage policies immediately and process claims instantly.

Direct-to-Consumer Insurance Models

D2C models revolutionize traditional insurance distribution by removing middlemen. This approach brings several benefits:

- Lower operating costs with fewer third-party deals

- Better data collection leads to individual-specific offerings

- Automated underwriting makes customer’s trip smoother

- Digital tools optimize claims processing

Hiscox demonstrates this success by a lot. Their D2C platform now insures about 600,000 small businesses. The model works especially well with professional liability, general liability, property, and cyber insurance for small businesses.

Digital Insurance Marketplaces

Embedded insurance drives growth substantially. The market should exceed USD 722 billion in global premiums by 2030. These marketplaces merge insurance offerings at purchase points through mutually beneficial alliances with the automotive, retail, and real estate sectors. Real estate companies now sell homeowner’s insurance directly on their platforms.

Distribution Technology Costs

Implementation costs vary based on the digital solution’s scope and complexity. Cloud computing leads the technology choices with the biggest market share. Companies that quickly adapt to these new distribution models see rapid growth and better margins. API architecture’s integration is vital because it enables digital distribution and offers more flexible channel interactions.

Personalized Insurance Solutions

Image Source: Qentelli

Individual-specific insurance solutions have changed dramatically. The usage-based insurance market reached USD 43.38 billion in 2023. This change shows how consumers need coverage that adapts to their behaviors and risk profiles.

Usage-Based Insurance Growth

The UBI market will expand to USD 70.46 billion by 2030, with a CAGR of 7.2%. Consumers are more willing to share their personal data with insurers. Research shows that 64% of Gen Xers and 69% of Millennials have a strong interest in embedded insurance products that offer flexible cancelation options.

Electric vehicles drive UBI adoption significantly. EV insurance premiums were higher because of limited data. Now, EV sales are gaining momentum, and insurers can access complete performance data that enables accurate risk assessment and competitive pricing.

Behavioral Premium Pricing

Insurance carriers now employ telematics devices and smartphone applications to track various driving behaviors:

- Mileage tracking and usage patterns

- Speed and braking patterns

- Time of day driving habits

- Vehicle performance metrics

This approach has shown remarkable results. Metromile’s pay-per-mile model uses their Pulse device to help customers save 47% compared to traditional insurance premiums. This success has encouraged other insurers to develop similar programs.

Real-Time Risk Assessment

Advanced data analytics help insurers process information 100 times faster than traditional methods. This capability has transformed risk evaluation processes. Real-time data gives underwriters immediate access to complete information about drivers, vehicles, and environmental conditions.

IoT devices and telematics systems have improved insurers’ knowledge of how to:

- Monitor driving patterns continuously

- Adjust premiums dynamically

- Provide immediate feedback to policyholders

- Detect and prevent fraudulent activities

Digital profiling will improve risk assessment capabilities soon. Insurers can analyze lifestyle patterns, health metrics, and behavioral data to create detailed risk profiles. This wealth of data presents privacy challenges that require robust protection measures to maintain customer trust.

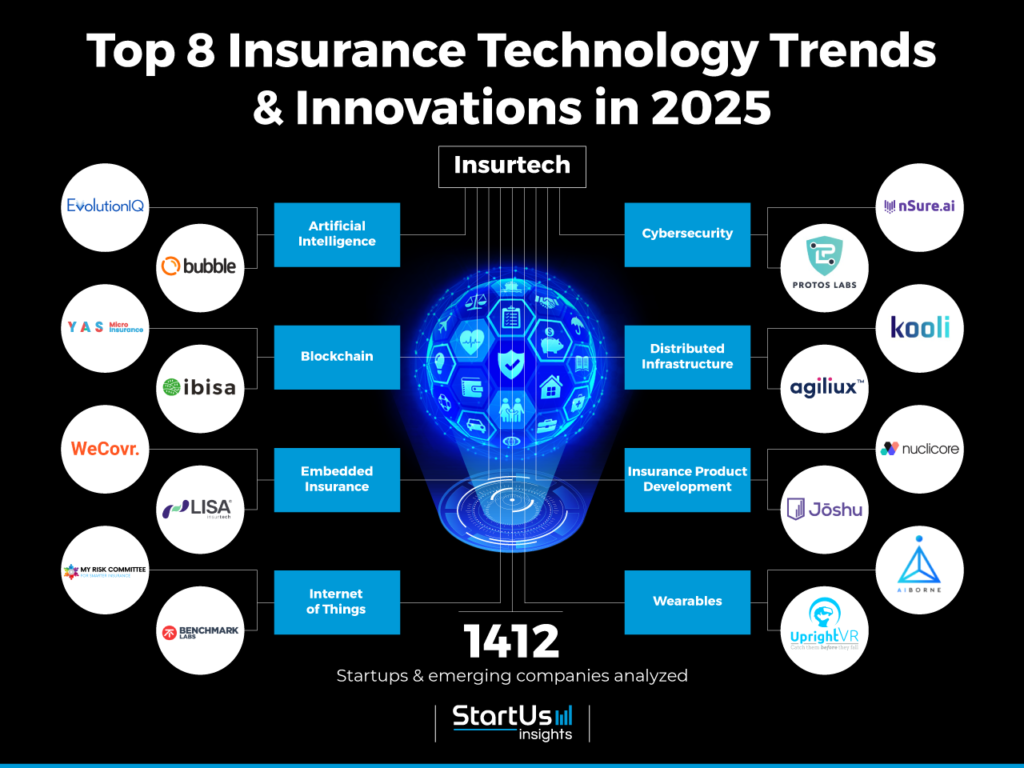

Insurance Industry Cybersecurity Evolution

Image Source: StartUs Insights

Cyber insurance claims exploded in 2023. Ransomware events shot up by 1,281% in the last five years. This unprecedented growth has altered the map of how insurers handle cybersecurity coverage and risk assessment.

Cyber Insurance Product Innovation

The cyber insurance market has grown beyond basic coverage and now offers specialized protection against emerging threats. Insurers provide complete solutions that cover ransomware protection, business interruption coverage, and data recovery services. The industry has seen remarkable breakthroughs in policy structures, and new products now address AI-driven threats and deepfake scams.

Data Protection Standards

The SEC has introduced stricter cyber-related disclosure rules. These standards require organizations to:

- Share cybersecurity governance details

- Report management and board oversight

- Set up complete information security programs

- Follow strict vendor management protocols

- Document incident response procedures

Cybersecurity Insurance Pricing

Cyber insurance pricing has stayed stable despite ongoing attacks and heightened geopolitical instability. Premium rates dropped by 15% in 2023. This trend varies by a lot based on several factors:

New insurers have entered the market offering up to USD 10 million in limits. Businesses with revenue between USD 25 million and USD 100 million saw the sharpest rise in claims – a 32% jump from last year.

The cyber insurance world faces new challenges from AI-powered attacks. 61% of respondents see this as the biggest threat for 2025. Supply chain vulnerabilities remain a critical concern. Gartner predicts that 45% of organizations will face attacks on their software supply chain by 2025.

Insurance Ecosystem Partnerships

Image Source: Scribble Data

Strategic collaborations have changed the insurance landscape. Carriers now turn to ecosystem collaborations that meet changing market conditions without major capital investments. These alliances help companies adapt to market changes quickly while keeping financial risks low.

Cross-Industry Collaborations

Insurance providers focus on partnerships that improve customer-centric operations. Zurich Insurance Group’s work with SAP shows this approach well. They offer personalized employee benefits through HR service integration. These partnerships now span multiple sectors:

- Smart home providers that deliver comprehensive protection services

- Original equipment manufacturers providing seamless auto insurance

- Wearables companies creating customized life insurance products

- Healthcare providers offering integrated wellness solutions

These cross-industry alliances help carriers sell products at vital customer touchpoints during major life events or big purchases. Some insurers work with real estate companies to offer homeowner’s insurance directly through property sales platforms.

Revenue optimization through partnerships has grown more sophisticated. Insurance carriers now utilize collaborative relationships to:

- Generate leads through bundled services

- Create new revenue streams via ancillary products

- Improve customer retention through integrated offerings

- Optimize distribution costs through shared platforms

Successful partnerships need balanced revenue-sharing models. To cite an instance, embedded insurance partnerships with automotive companies show remarkable success. Carriers can offer customized coverage at the point of sale. These collaborations improve customer retention rates by 14%.

This partnership approach works well to address protection gaps. Natural disasters caused total losses of USD 380 billion globally in 2023. Insurance covered only USD 118 billion. Insurance companies now reach previously underserved markets through strategic alliances. They develop groundbreaking solutions for emerging risks.

Insurance Workforce Transformation

Image Source: Genius

Technology has altered the map of the insurance workforce. By 2030, 14% of workers worldwide will need to change occupations and learn new skills. Insurance companies must completely rethink their approach to managing and developing talent.

Digital Skills Requirements

Insurance companies will need 55% more technological expertise by 2030. Key areas of expertise include:

- Data analytics and visualization

- Artificial intelligence literacy

- Cloud computing proficiency

- Cybersecurity awareness

- Digital collaboration tools

Many insurance companies find it challenging to blend new capabilities like data science and digital design into their core business. Successful companies have hired translators who connect technical roles with traditional business functions.

Remote Work Impact

Insurance ranks among industries with the highest potential for remote work. 75% of tasks can be handled remotely without losing productivity. Before the pandemic, only 4% of workers worked exclusively from home. This number jumped to 43% by May 2020.

Remote operations have led insurance companies to invest in digital collaboration tools while restructuring their property holdings. Companies have discovered new ways to adopt hybrid workforces through:

- Smaller office spaces

- Converting traditional workstations to hot desks

- Creating adaptable work environments

Training and Development

Companies that invest in learning and development see 23% higher profits. L&D programs help strengthen product knowledge and enable agents to explain coverage options confidently. LinkedIn research shows that 94% of employees stay longer with companies that invest in their career growth.

Insurance companies face unique challenges when quickly upskilling and reskilling at scale. Virtual environments now replace traditional in-person training methods. McKinsey’s research reveals replacing an employee costs more than 100% of their yearly salary, while successful reskilling costs less than 10%.

Talent Acquisition Strategies

The talent shortage has become one of the industry’s most critical risks. Insurance companies no longer focus solely on college graduate programs. Their expanded approach includes:

- High school engagement programs

- Apprenticeship initiatives

- Cross-industry talent acquisition

- Technology-focused recruitment

Insurance leaders consider human capital their scarcest resource. Companies increasingly seek diverse talent to encourage breakthroughs and better represent their communities. McKinsey Global Institute’s analysis shows highly skilled insurance workers can work remotely three or more days weekly as effectively as they would in an office.

Comparison Table

| Trend | Market Size/Growth | Key Technologies/Features | Primary Benefits | Implementation Challenges | Notable Statistics |

| AI-Powered Insurance Technology | €6,000-€300,000 for custom solutions | Computer vision, Machine learning, Natural language processing | Shorter claims lifecycle, Better risk assessment, 24/7 customer service | Data infrastructure problems, Legacy system integration | 76% of U.S. insurance firms implementing AI; 14% improvement in customer retention |

| Climate Risk and Green Insurance | $380B in global disaster losses (2023) | Parametric insurance, Advanced climate risk modeling, Catastrophe models | Pre-defined payouts, Better risk assessment, Green practices | Rising remediation costs | 1.4% increase in median pricing (2024); Only $118B covered by insurance |

| Digital-First Insurance Distribution | $50.70B market by 2029 (16.4% CAGR) | Mobile platforms, D2C models, Digital marketplaces | Lower operating costs, Better data collection, Optimized customer experience | Integration complexity | $722B in global premiums expected by 2030 for embedded insurance |

| Tailored Insurance Solutions | $43.38B (2023) to $70.46B by 2030 | Telematics, IoT devices, Live monitoring | Dynamic pricing, Immediate feedback, Fraud prevention | Privacy protection challenges | 47% average savings with pay-per-mile model; 7.2% CAGR |

| Insurance Industry Cybersecurity | 15% decrease in premium rates (2023) | Risk assessment platforms, Cyber risk modeling, Protection services | Complete threat coverage, Better risk evaluation | Evolving AI-powered threats | 1,281% increase in ransomware events over 5 years |

| Insurance Ecosystem Partnerships | $722B in premiums by 2030 | API integration, Cross-industry platforms | Better customer retention, New revenue streams, Market expansion | System integration challenges | 14% improvement in customer retention rates |

| Insurance Workforce Transformation | N/A | Digital collaboration tools, Remote work platforms | Boosted productivity, Cost savings | Talent shortage, Reskilling needs | 14% of the workforce needs reskilling by 2030; 75% of activities manageable remotely |

Conclusion

Insurance companies are changing fast, and these seven trends show how the industry is transforming. Companies that accept new ideas see remarkable results. AI adoption improves customer retention by 14%, while usage-based insurance models save costs by 47%.

Companies need a balanced strategy to succeed in this new digital world. They must invest in technology capabilities and preserve human expertise. Research shows that teams can manage 75% of insurance work remotely. However, personal relationships remain vital for complex risk assessment and building customer trust.

Insurance companies should prioritize these three key actions:

- Upgrade technology infrastructure to support AI and data analytics

- Build strategic collaborations in various industries

- Invest in workforce development and digital skills

Insurers who combine state-of-the-art technology with human expertise will own the future. They must adapt to customer’s changing needs and environmental challenges. Companies taking action now will lead the industry in 2025 and beyond.

FAQs

What are the key insurance technology trends shaping the industry in 2025?

The main trends include AI-powered solutions for claims processing and risk assessment, climate risk modeling, digital-first distribution platforms, personalized insurance products, advanced cybersecurity measures, ecosystem partnerships, and workforce transformation focused on digital skills.

How is artificial intelligence impacting the insurance industry?

AI is revolutionizing insurance by automating claims processing, enhancing risk assessment through machine learning, and improving customer service with AI-powered virtual agents. It’s helping insurers reduce costs, increase efficiency, and provide more personalized services to customers.

What challenges does the insurance industry face in implementing new technologies?

Key challenges include integrating new systems with legacy infrastructure, addressing data privacy concerns, managing cybersecurity risks, and upskilling the workforce to handle new digital tools. Insurers also face difficulties in balancing technological innovation with maintaining personal customer relationships.

How are insurance companies adapting to climate change risks?

Insurers are developing advanced climate risk modeling techniques, creating new environmental insurance products, and implementing sustainable practices. They’re also focusing on parametric insurance solutions and working to close the protection gap for natural disaster coverage.

What role do partnerships play in the future of insurance?

Strategic partnerships are becoming crucial for insurers to expand their offerings and reach new markets. These collaborations, often facilitated by API integrations, allow insurers to provide embedded insurance solutions, access new data sources, and offer more comprehensive services to customers across various industries.